Learn the habit of saving

It’s not easy to save money in today’s economic climate. White-hot inflation continues to deplete savings. Companies are announcing major layoffs. Living paycheck to paycheck has become the norm for many.

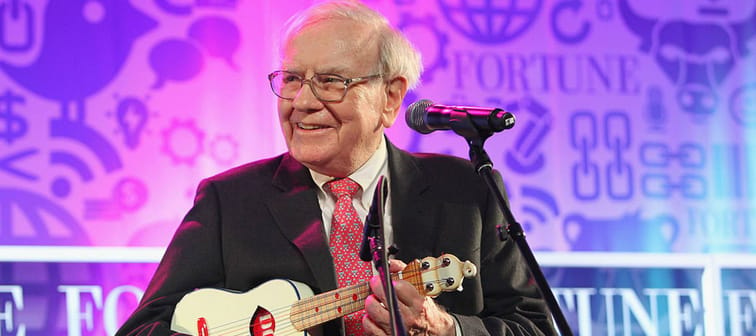

That’s not what Buffett wants to see. During an episode of the Dan Patrick Show, Buffett was asked what he thought was the biggest mistake people make when it comes to money.

“Not learning the habits of saving properly early,” the legendary investor replied. “Because saving is a habit. And then, trying to get rich quick. It's pretty easy to get well-to-do slowly. But it's not easy to get rich quick.”

In other words, instead of trying to become a millionaire overnight, it’s probably wiser to get into the habit of saving and building a nest egg slowly but steadily.

Meet Your Retirement Goals Effortlessly

The road to retirement may seem long, but with WiserAdvisor, you can find a trusted partner to guide you every step of the way

WiserAdvisor matches you with vetted financial advisors that offer personalized advice to help you to make the right choices, invest wisely, and secure the retirement you've always dreamed of. Start planning early, and get your retirement mapped out today.

Get StartedForget that Lambo

If money is no object, what type of vehicle would you drive? A Mercedes, Bentley, or perhaps the prancing horse from Maranello?

Those might be what we think of as “rich people cars,” but you won’t find them in Buffett’s garage.

In fact, he’s known for being especially frugal with cars.

“You’ve got to understand, he keeps cars until I tell him, ‘This is getting embarrassing — time for a new car,’” his daughter once said in a documentary.

After all, we’re talking about the man who once had a vanity license plate that read “THRIFTY.”

There are many reasons why you might want to think twice before purchasing a luxury car.

The first is depreciation. Cars start losing their value the moment you drive them off the lot. An analysis by iSeeCars found the average five-year old car in 2022 had lost 33.3% of its original value. Luxury brands tended to lose even more value. The average five-year depreciation for a Mercedes S-Class was 51.9%. For a BMW 7 Series, it was 56.9%.

Moreover, luxury cars can cost more to maintain and insure than economy cars. So you have to fork up more than just the purchasing price. And once luxury cars run out of warranty, they can also be more expensive to repair.

Don’t forget, there’s opportunity cost as well. The money you spend on an expensive vehicle could have been put into your investment portfolio and earn a return year after year. That potential return — which can get compounded as time goes by — is your opportunity cost. And it can add up.

Buy quality and value

Buffett’s frugality is particularly evident in his investing style.

“Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down,” he wrote in his 2008 Berkshire Hathaway shareholder letter.

In particular, Buffett is a proponent of value investing, which is a strategy that involves buying stocks that are trading below their intrinsic value.

It’s clear where he got that idea: Buffett was a student of Benjamin Graham, widely known as the “father of value investing.”

“Long ago, Ben Graham taught me that ‘Price is what you pay; value is what you get,’” Buffett wrote in 2008.

By purchasing stocks of companies that are trading at a discount to their intrinsic value, investors can achieve a margin of safety.

But that doesn’t mean Buffett will pick up just any stock on the floor. The Oracle of Omaha also looks for companies that have a durable competitive advantage.

A look at Buffett’s portfolio can give you an idea of what those companies might be. Berkshire’s largest publicly traded holdings are Apple, Bank of America, Chevron, Coca-Cola and American Express — companies with deeply entrenched positions in their respective industries.

So what if you have to choose between quality and price? It’s probably better to focus on quality, as long as the price is “fair.”

In Buffett’s own words, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Stop overpaying for home insurance

Home insurance is an essential expense – one that can often be pricey. You can lower your monthly recurring expenses by finding a more economical alternative for home insurance.

SmartFinancial can help you do just that. SmartFinancial’s online marketplace of vetted home insurance providers allows you to quickly shop around for rates from the country’s top insurance companies, and ensure you’re paying the lowest price possible for your home insurance.

Explore better ratesA better way to find value?

Of course, buying high-quality value stocks isn't the only prudent way to invest.

Amid hot inflation and the uncertain economy, veteran investors are still finding ways to effectively invest their millions outside of the stock market.

Prime commercial real estate, for example, has outperformed the S&P 500 over a 25-year period. With the help of new platforms, these kinds of opportunities are now available to retail investors. Not just the ultra-rich.

With a single investment, investors can own institutional-quality properties leased by brands like CVS, Kroger and Walmart — and collect stable grocery store-anchored income on a quarterly basis.

Sponsored

Follow These Steps if you Want to Retire Early

Secure your financial future with a tailored plan to maximize investments, navigate taxes, and retire comfortably.

Zoe Financial is an online platform that can match you with a network of vetted fiduciary advisors who are evaluated based on their credentials, education, experience, and pricing. The best part? - there is no fee to find an advisor.