Actively managed vs. passively managed funds

astarot / Shutterstock

Updated: August 15, 2023

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Please be aware that some (or all) products and services linked in this article are from our sponsors.

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Please be aware that some (or all) products and services linked in this article are from our sponsors.

When you're looking to invest, one of the best places to look is a mutual fund or exchange-traded fund (ETF). These funds allow you to put your money into a diversified investment that can include a variety of stocks, bonds, and other assets. But before you click the buy button, it's important to understand the difference between actively managed funds and passively managed funds.

- Actively managed mutual funds and ETFs- rely on a fund manager who buys and sells stocks and other investments with a goal of earning the investors (and fund managers) as much as possible.

- Passively managed fund- With this, the investment follows an index or uses another strategy where the fund manager is not regularly churning through different investments on your behalf.

Which is best for you? Keep reading to find out more about the difference between actively managed and passively managed funds and learn which may be best for you.

What is an actively managed fund?

An actively managed fund is a fund that's managed by a professional investment manager. The manager typically picks stocks or other assets in line with the fund's goals.

The general goal of an actively managed fund is to beat the market. The fund management team picks individual investments, and if all goes according to plan, the fund will outperform when compared to its category and benchmark index.

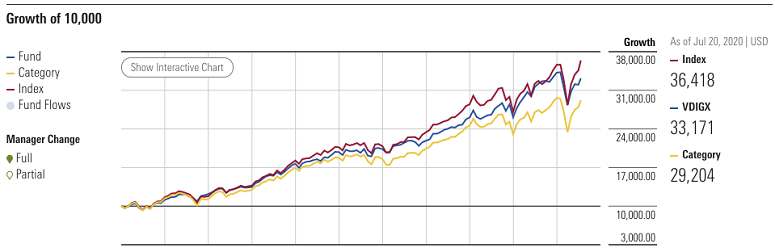

An example of this type of fund is the Vanguard Dividend Growth mutual fund (VDIGX). This fund employs professional stock pickers who look for “high-quality companies that have both the ability and the commitment to grow their dividends over time.” This fund charges 0.27% of your total investment annually and has a turnover rate of 17%. The turnover rate tells you how much of the fund's assets are replaced each year.

One of the best ways to judge the performance of a fund is to compare it to its benchmark index. As of this writing, the VDIGX is trailing the market over the last decade but doing better than industry peers.

Actively managed funds typically underperform compared to their index benchmark. Over the last 15 years, 88% of actively managed domestic stock funds have underperformed compared to the S&P 1500 index.

Pros and cons of active fund management

Pros

- Fund managers may be able to lessen the impact of market downturns

- Some fund managers have a track record of beating the market

Cons

- Typically underperforms compared to market indices

- Often high fund management fees

Our favorite brokers to invest in actively managed funds are Ally Invest and E*TRADE. Here's a quick comparison between the two:

What is a passively managed fund?

Passively managed funds don't have busy fund managers picking stocks behind the scenes. Instead, they typically follow a market index or a similar strategy. As investors make deposits or withdrawals, the fund managers make simple adjustments to the fund's holdings to keep the assets in line with the target index.

Some fund providers offer both actively and passively managed funds. For example, Vanguard is best known for its low-cost index funds. The Vanguard 500 Index Fund follows the popular S&P 500 index. It charges just 0.03% or 0.04% in annual fees depending on the version you buy. This fund trades as a mutual fund under ticker symbol VFIAX. A similar ETF trades with the symbol VOO.

Most passively managed funds charge less than actively managed funds, because they don't need the same type of fund manager to do the work of picking stocks. That savings can add up to thousands of dollars over the years when investing for retirement and other long-term goals. That definitely makes shopping around for the lowest-cost fund worth the effort.

Pros and cons of passive fund management

Pros

- Fund performance typically matches market indices

- Generally low cost

- Often includes a very broad number of assets with one purchase

Cons

- Will never beat the market

- No human manager to update portfolio when market conditions change

How do they compare?

Passively managed index funds have enjoyed massive success over the last decade. While actively managed funds paved the way for the fund industry as we know it today, 2019 marked the year when the amount of money invested in passively managed funds exceeded the amount in actively managed funds.

There are two big reasons for this multi-trillion dollar shift in investments:

- 1.

Passively managed funds typically outperform actively managed funds.

- 2.

Passively managed funds typically charge less than actively managed funds.

If you can pay less to get a better product, that's what you're going to do. And that's exactly the case in the mutual fund and ETF industry.

While there are a few exceptions and some funds have rock-star years from time to time, the general trend is clear. Actively managed funds underperform more than eight times out of 10 compared to the index. Why would you pay extra for that?

Historic performance: active vs. passive funds

When it comes to historic performance, passive funds beat active funds more than 80% of the time. That's not a small margin!

Actively managed funds in the United States missed the market index benchmark 88.4% of the time over the last 15 years. Large-cap funds fared worse than mid-caps and small-caps, with 87.7% underperforming the benchmark. Mid-cap and small-cap funds each missed the index 82.2% of the time.

International equity funds missed 80% to 90% of the time. For some reason, international small-cap funds performed better. But they still missed the index 62.5% of the time.

In some bond and fixed-income categories, the index outperformed in more than 99% of cases. That's pretty incredible. With that kind of statistic, I don't know why anyone would ever buy an actively managed bond fund.

Should you invest in a passively or actively managed fund?

Investments are all about making money. Even if you're not “a numbers person,” it's easy to follow the numbers here. When passively managed funds follow the index closely while more than 80% of actively managed funds underperform the index, it's clearly a better call to invest in a passive fund.

There are still advocates of active fund managers, but history doesn't prove their point. If you're looking to start investing or want to upgrade your investment strategy, the best place for most people to look is passively managed index funds. The performance and low cost make them a clear winner for long-term investment goals.