CrowdStreet review

Moneywise.com / Moneywise.com

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Please be aware that some (or all) products and services linked in this article are from our sponsors.

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Please be aware that some (or all) products and services linked in this article are from our sponsors.

CrowdStreet

CrowdStreet is an online private equity real estate investing platform that lets accredited investors add commercial real estate to their portfolios.

It's one of many companies in the crowded real estate crowdfunding market. But with a rigorous vetting process and comprehensive marketplace, it's one of the leading platforms for commercial real estate investing. However, the high minimum funding requirements and low liquidity are potential barriers for some investors.

Our CrowdStreet review is covering how the platform works, the requirements, and how you can ultimately decide if this is a good investment.

CrowdStreet features

- Deal transparency: Like most other real estate crowdfunding sites, CrowdStreet provides comprehensive information and documents on each project before and during the process. This allows investors to perform their own due diligence, as well as receive ongoing support, information, and updates before and after investing.

- IRA accessibility: If you have a self-directed IRA, you can invest in CrowdStreet deals.

- Terms: Current investment opportunities at the time of this writing range between two and 12 years.

- Investments are pre-screened: Every investment opportunity applying for inclusion to the CrowdStreet Marketplace is subjected to a rigorous, objective vetting process. Only 2% of all applicants successfully pass this process and appear on CrowdStreet's marketplace.

- Direct sponsor investment: CrowdStreet is one of only two major marketplaces to operate under a direct-to-investor model, whereby investors can invest directly with the sponsor instead of through a special purpose vehicle. The direct-to-investor model may result in a lower overall risk to the investor.

How does CrowdStreet work?

CrowdStreet began in 2013, and it provides private equity, commercial real estate investment opportunities.

The company connects sponsors (real estate operators and developers) with investors who want in on commercial real estate. But there are three main ways to actually invest with CrowdStreet that may suit different investing goals.

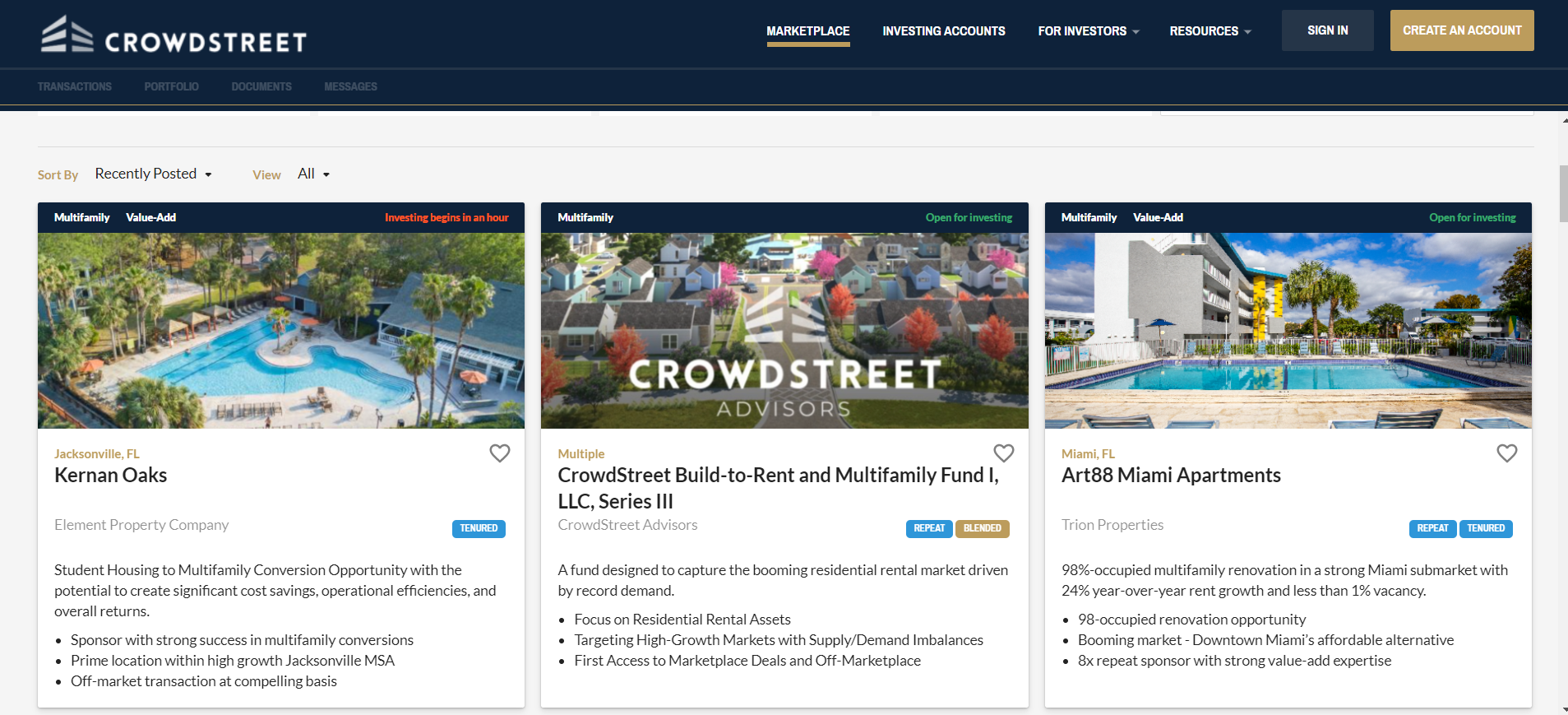

CrowdStreet marketplace deals

The most popular method of CrowdStreet investing is to invest in individual deals through its marketplace.

The marketplace is where sponsors can list their commercial real estate projects that are in development for investors to consider. CrowdStreet charges sponsors in exchange for listing them on its marketplace and for helping to raise capital. In turn, investors get to invest directly in sponsors and real estate projects they want in their portfolios.

You find a variety of deals on CrowdStreet's marketplace. Deals generally have a minimum holding period of two to ten years and have a $25,000 minimum investment requirement. However, minimum investment requirements can be as high as $100,000 or more for some deals.

You can also use filters to find deals with varying loan-to-cost percentages and distribution periods (monthly, quarterly, semi annually, or annually.)

Deals also have information about the properties, cash flow, neighboring areas, and sponsor details to help with your due diligence.

To date, over $3.16 billion has been invested across 629 deals, yielding over $591 million in distributions. And what truly sets CrowdStreet apart from many competitors is its vetting process for sponsors. CrowdStreet's team assesses sponsors' track record and assign them a corresponding designation:

- Emerging: 2–5 years' experience with portfolio activity up to $100M, experience in both geographical region and proposed asset class.

- Seasoned: 5+ years' experience with portfolio activity over $100M, with an existing network of repeat investors and established banking relationships.

- Tenured: 10+ years' experience with portfolio activity of over $500M, with principals who have invested together through multiple real estate cycles, and the company has a dedicated staff for investor relations and accounting.

- Enterprise: 15+ years for firm age and 30+ years of principle experience with a total portfolio value of $5 billion or more.

CrowdStreet also reviews sponsor applications based on the business plan, market data, operating statements, pro-forms, appraisals, and other due diligence documents.

According to its website, roughly 2% of applicants reach approval. Following approval, deals go live on the marketplace and can follow various investment structures, like equity or mezzanine debt, although most deals are equity-based.

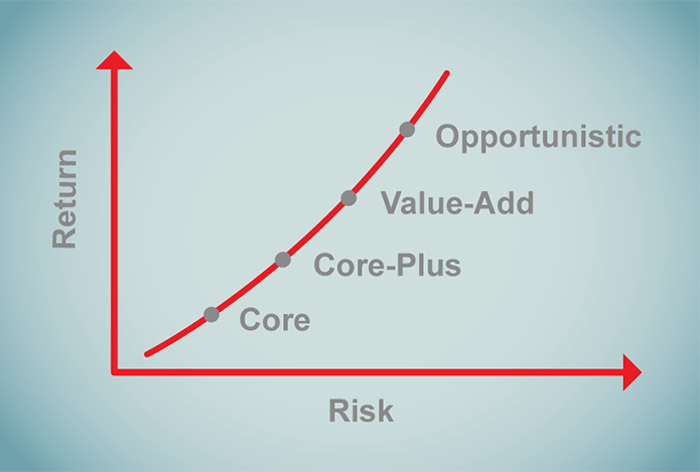

Finally, CrowdStreet assigns an investment profile to deals to help investors find the right deal for their investing goals:

- Core: The least risky investment class that's comprised of fully-occupied properties with stable cash flow.

- Core Plus: These are mostly-occupied properties with relatively stable cash flow but have some income set aside for upgrades and maintenance.

- Value-added: These projects aim to significantly increase cash flow and property value through dramatic property improvements.

- Opportunistic: Have the highest possible returns but also more risk. Includes brand new development projects and projects that have little to no cash flow.

Ultimately, CrowdStreet's marketplace has a diverse range of commercial real estate deals. And you can filter for different levels of risk tolerance to find projects you're comfortable with.

New CrowdStreet REIT I (C-REIT)

The CrowdStreet marketplace mostly offers individual deals. It occasionally lists some funds, but historically, it's focused on individual deals between investors and sponsors.

However, CrowdStreet is getting into the REIT game like other crowdfunding platforms. With its launch of the CrowdStreet REIT I, or C-REIT, you can invest in a portfolio of growth-oriented, private commercial real estate projects.

This C-REIT has 20 to 25 deals and requires a $25,000 minimum investment. If you want more diversification and don't have time to conduct due diligence on dozens of individual marketplace deals, it's the perfect solution.

This REIT has a target holding period of five to seven years and includes projects across different regions and from a range of sponsors.

Tailored portfolio

The third way to invest with CrowdStreet is to work with an advisor to build a custom commercial real estate portfolio.

This service is provided by CrowdStreet Advisors LLC, which is a subsidiary of CrowdStreet. You need a $250,000 minimum balance and account fees vary depending on investment size.

You work with an advisor and start by scheduling a call to cover your investing goals and risk tolerance. From there, your advisor selects deals that match these goals and deploys your funds. If you're investing serious capital and want advice and ongoing portfolio management, this is the option for you, provided the fees make sense for your portfolio.

Crowdstreet investing requirements & minimums

Investments on CrowdStreet's marketplace are only available to accredited investors and have a $25,000 minimum.

To become an accredited investor, you must have a net worth over $1 million by yourself or with a spouse. Alternatively, you must have an independent earned income that exceeds $200,000 in each of the prior two years or $300,000 in earned income together with a spouse.

Holding periods and liquidity

CrowdStreet sponsors generally have target hold periods of three to five years. However, some CrowdStreet deals have holding targets as long as 10 years.

You can't sell your CrowdStreet investments before the end of a holding period like you can with stocks or ETFS. This lack of liquidity is one of the downsides of CrowdStreet and real estate investing in general. In short, treat CrowdStreet as a mid- to long-term investment.

It's worth noting that some crowdfunding companies like Fundrise have secondary marketplaces where you can sell your shares, so liquidity concerns aren't as high.

Benefits of real estate crowdfunding

Through technology, crowdfunding real estate companies offer features and benefits previously unavailable to mainstream investors, including:

- 1.

The opportunity to directly invest in commercial real estate: investors can buy a stake in specific properties that they choose, instead of the two more complicated options: a. Buying into a publicly-traded real estate company that owns dozens of properties. b. Buy a mutual fund that includes an assortment of different real estate companies.

- 2.

Online convenience: Access to institutional-quality commercial real estate offerings in real-time.

- 3.

National access: Access to deals investors would otherwise have no knowledge of or ability to invest in. Investors aren't limited to investing locally. They can select the specific property type, the location, and the sponsor that best suits their investment strategy and objectives, anywhere in the nation. At the same time, sponsors can now just as easily accept an investor from across the country as from across town, which has spurred sponsor interest in developing a national, rather than regional, investor base.

- 4.

The ability to compare and contrast multiple investments: Many platforms allow you to easily and quickly compare and contrast competing offerings to find projects that fit your investment criteria.

- 5.

Lower minimum investment: In the past, the ability to invest in a real estate private offering usually came with a minimum investment amount of $100,000 or greater. Through online crowdfunding platforms, investors can access institutional-quality real estate offerings for as little as $5,000 or $10,000.

- 6.

Diversification: Rather than sinking $100,000 into a single property and waiting for it to reach maturity, investors can now choose to invest $10,000 into ten different deals that vary by geographic regions, sponsors, investment structures, asset classes, risk profiles and holding periods.

Is CrowdStreet a good investment?

If you want to add commercial real estate to your portfolio and aren't afraid of doing your own due diligence, CrowdStreet is worth considering.

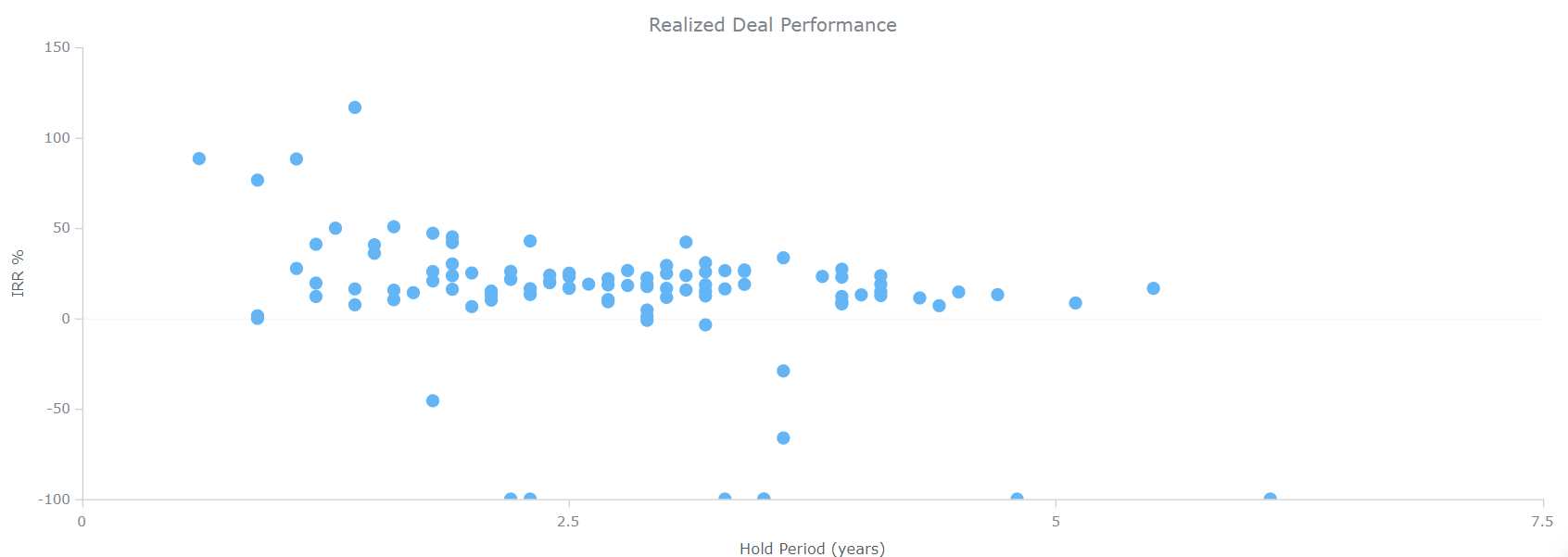

To date, the platform has funded over 629 deals, with $3.16 billion invested and $591 million in distributions. It also has a 18.3% internal rate of return (IRR), and you can view a list of realized deal performance history on CrowdStreet's website.

However, CrowdStreet correctly states on its website that in commercial real estate, risk greatly influences potential returns. For example, CrowdStreet has safer but less lucrative core deals that provide predictable cash flow. But it also has opportunistic deals and value-add deals that have higher potential returns but carry more risk.

Ultimately, you need to decide your level of risk tolerance, target returns, and research CrowdStreet investment opportunities carefully. CrowdStreet has a promising track record and can be a good investment, but you always need to do your own due diligence as well.

Fees and pricing

CrowdStreet doesn't charge investors with fees, which is an advantage of this real estate investing platform. However, sponsors may charge fees in exchange for providing investment opportunities.

There's a variety of potential sponsor fees, and CrowdStreet provides more detail on its website about potential fees. Fees typically range from 2% to 5% and also vary by project.

However, a lack of direct investor fees is one perk of CrowdStreet versus many crowdfunding platforms.

CrowdStreet alternatives

CrowdStreet is an excellent platform for accessing vetted commercial real estate opportunities. But with a $25,000 minimum investing requirement for many projects, it's not very beginner-friendly. And until more regular opportunities appear for non-accredited investors, the accreditation requirement is another potential barrier.

However, there are numerous CrowdStreet alternatives you can use to add real estate to your portfolio.

| Highlights | Fundrise | CrowdStreet | RealtyMogul |

|---|---|---|---|

| Rating | 4.5/5 | 4/5 | 4.5/5 |

| Minimum investment | $10 | $25,000 | $5,000 |

| Account fees | 1%/year | None | 1-1.25%/year asset management fee |

| Private REIT | ✅ | ✅ | ✅ |

| Read reviews | Fundrise review | CrowdStreet review | RealtyMogul review |

| Get started | Sign up | Sign up | Sign up |

Fundrise is the best alternative for investing in real estate with little money since it has a $10 funding minimum and is open to non-accredited investors.

As for RealtyMogul, it's another reputable commercial real estate investing platform for accredited and non-accredited investors alike. And its $5,000 investing minimum is significantly lower than CrowdStreet.

CrowdStreet is still an excellent choice for accredited investors who want to do their own research. But definitely consider other real estate investing opportunities, especially if you want lower investing minimums.

This is a testimonial in partnership with Fundrise. We earn a commission from partner links on Moneywise. All opinions are our own.

CrowdStreet pros and cons

Pros

- No direct fees: CrowdStreet doesn't charge investors directly with fees.

- Only commercial real estate: Unlike other marketplaces that mix single-family home fix-and-flips with commercial real estate offerings, CrowdStreet is 100% focused on the commercial real estate market, and this shows in the quality of the investment offerings available on the site.

- Deal access: Access to deals that investors would otherwise have no knowledge of or ability to invest in.

- Easy to compare opportunities: CrowdStreet puts all of its offering information and documents into the same format. This makes it easy for investors to compare and contrast numerous deals that meet their investment criteria.

- Dashboard tools: A key feature of online crowdfunding platforms is the use of technology to make real estate investing more efficient, transparent and scalable through online dashboard tools. CrowdStreet is continually improving their dashboard to include helpful projection and deal comparison tools. Its latest iteration includes comprehensive portfolio analytics.

Cons

- High minimum investment: CrowdStreet has a minimum investment requirement of $25,000 for many deals, which is on the higher end. For many other real estate crowdfunding sites, the minimum per deal is just $5,000, with some even as low as $10 like with Fundrise.

- No liquidity: Like most real estate investments and crowdfunding platforms, once you make an investment, you are pretty much committed to the investment for the term. There is currently no secondary market to sell your investment to others.

Bottom line

In any market, when efficiency, scalability, and choice arrive, consumers typically win. As the online real estate investment market continues to grow, the quality of investment choices and terms available will likely continue to improve as more investors enter online marketplaces, and more sponsors enter and compete to attract them.

The bottom line is that CrowdStreet offers access to a large volume of vetted commercial real estate deals, both equity and debt, and doesn't charge investors direct fees. If you meet accreditation requirements and funding minimums, it's an excellent platform to invest with.

Open a CrowdStreet account