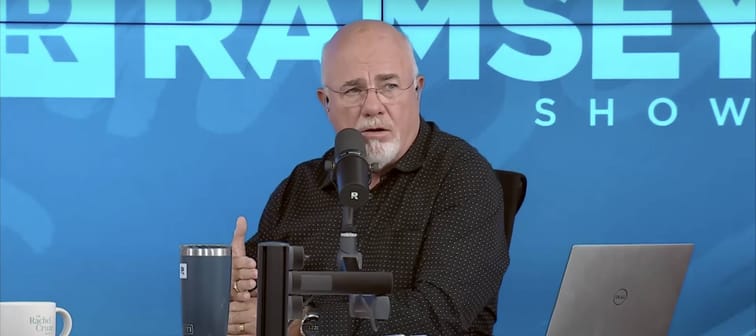

What Ramsey says is holding people back

You can save enough for retirement by putting $100 per month in a conservative growth fund from age 25 to 65, Ramsey said, but for that to work, “You can’t have a $750 F-150 payment. You can’t have a student loan that’s been around so long you think it’s a pet.”

He added: “All you do is work for these stinking banks that have better furniture and bigger buildings than you do.”

Ramsey went on to state that debt has become normalized in America if not throughout the world. It’s now a huge obstacle for those seeking to save money and put that cash toward retirement.

Yet, instead of paying back debt, consumers seem to be using credit cards and other loan methods to continue funding their daily spending, Ramsey said. Rather than cut back during inflation, consumers chose to make up for the shortfall by borrowing money to maintain their lifestyles.

Ramsey stated that people’s continual reliance on consumer debt has kept him in the financial advice-giving business for the last several decades and will give him job security for several more.

That’s why it’s a great time to remind Americans about Ramsey’s baby steps to secure your finances and kick debt to the curb.

Kiss Your Credit Card Debt Goodbye

Having a single loan to pay off makes it easier to manage your payments, and you can often get a better interest rate than what you might be paying on credit cards and car loans.

Fiona is an online marketplace offering personalized loan options based on your unique financial situation.

When you consolidate your debt with a personal loan, you can roll your payments into one monthly installment. Find a lower interest rate and pay down your debt faster today.

Get StartedCreate a $1,000 emergency fund

Ramsey's guidance here is to start an emergency fun with $1,000. He's since come out to say that was never meant to be enough for Americans. However, even as you work to pay down your debt, this is the bare minimum amount you should have put aside, because life happens.

Down the line, you can start contributing far more to this fund. But, if you're suddenly hit with a big medical bill, a broken-down vehicle or some other emergency, you’ll want that $1,000 available to avoid losing all the steam you’ve gained on your debt payments.

Pay off all debt (except the house)

Granted, almost no one has hundreds of thousands of dollars available to pay off their mortgage in one go, but by using the snowball method Americans can pay down the rest of their debt in a reasonably quick period of time, Ramsey claims.

To do this, list your debts, from student loans and car payments to credit cards. Order them from the smallest balance to the largest, regardless of interest rate, Ramsey says. Start making the minimum payments on everything except that little loan, putting everything you can toward it. The smallest loan is often a credit card balance, which is helpful, as it’s usually also the account with the highest interest rate. Repeat with the next smallest balance, then the next, until you’re debt-free.

Achieving this is going to require you to cut back spending, Ramsey says — so it may be time to re-evaluate what’s actually necessary in your life.

“When you actually consider the way we all live, it’s outrageous,” Ramsey said. “Our lifestyles are outrageous.”

Stop overpaying for home insurance

Home insurance is an essential expense – one that can often be pricey. You can lower your monthly recurring expenses by finding a more economical alternative for home insurance.

SmartFinancial can help you do just that. SmartFinancial’s online marketplace of vetted home insurance providers allows you to quickly shop around for rates from the country’s top insurance companies, and ensure you’re paying the lowest price possible for your home insurance.

Explore better ratesCreate a fully funded emergency fund

Now, stop for a minute and celebrate. You’ve paid off your debt! This is a huge step that deserves congratulations. But there's still so much more to do. You can start investing and saving toward long-term goals. Before any of that, however, you'll want to circle back and top up your emergency fund.

Ideally, you should have between three and six months of expenses put aside for your household. This means you’re going to have to go back and look at what you’ve spent over the last three to six months. On the bright side, by now you may have already cut back on expenses dramatically. Even better, you’ve created a habit of paying down debt on a consistent basis. So, now you simply put the money you were using on debt toward savings.

Once this emergency stash is funded, you’ll be protected should one of life’s enormous surprises — like a layoff or long hospital stay — comes your way. If you’re lucky, this won’t happen and you can use your emergency fund as income down the road. But having it available will give you peace of mind.

“You just have to look in the mirror and tell yourself, ‘Boy, we buy some really stupid stuff,’” Ramsey said. “Don’t be a victim. You’re not a victim. You’re a victim of the person in your mirror.”

Sponsored

Follow These Steps if you Want to Retire Early

Secure your financial future with a tailored plan to maximize investments, navigate taxes, and retire comfortably.

Zoe Financial is an online platform that can match you with a network of vetted fiduciary advisors who are evaluated based on their credentials, education, experience, and pricing. The best part? - there is no fee to find an advisor.