The starting point

In order to start building a credit score, you must have an account that reports your payment history and balance to one of the three big credit bureaus: TransUnion, Experian and Equifax.

You need at least six months of credit history to qualify for a FICO credit score — which is the most common scoring metric. Your credit history makes up 15% of your FICO score.

Six months is pretty much the bare minimum in terms of credit history. In many cases, lenders consider anything between two to four years of history a good starting point. A solid history that will count as a positive in your favor is about 10 years of good credit.

Kiss Your Credit Card Debt Goodbye

Having a single loan to pay off makes it easier to manage your payments, and you can often get a better interest rate than what you might be paying on credit cards and car loans.

Fiona is an online marketplace offering personalized loan options based on your unique financial situation.

When you consolidate your debt with a personal loan, you can roll your payments into one monthly installment. Find a lower interest rate and pay down your debt faster today.

Get StartedWhat is a good credit score?

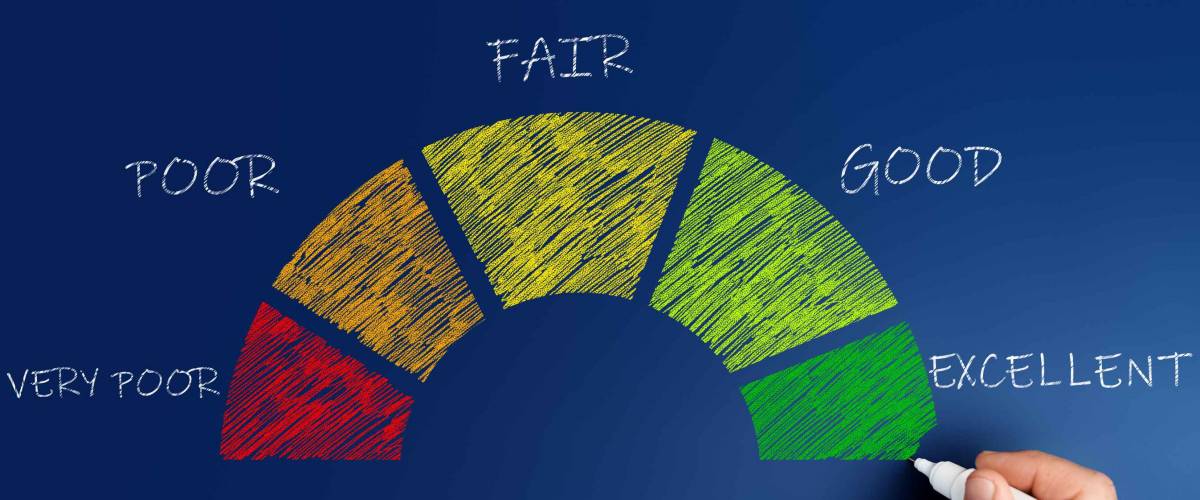

Credit scores from 580 to 669 are typically considered fair. A score of 670 to 739 is considered good; 740 to 799 is seen as very good; and 800 and higher is considered excellent. If you’re just starting out building your credit, a score in the low 700s is a good target to aim for.

When you begin building credit, however, you don’t start with a 0 or a very low number like 300.

Precisely how credit is scored is the stuff of complicated algorithms and trade secrets, but there are things we know help it go up: pay your bills on time, don’t carry a big balance and don’t open too many accounts too close together.

With that said, here are some other ways to build your credit score.

Looking to keep building up your credit and get some rewards at the same time? You can get a no-fee, cash-back Visa card to do exactly that.

How time affects your credit score

Having older credit accounts with a good payment history shows lenders that you’re responsible with your financial obligations. But lenders will also look at other things, like the number of accounts you have and their average age.

Your overall credit history is tied pretty closely to the things you’d expect: Payment history, the amount of debt you’re carrying and new accounts you’ve opened recently. There are many factors that go into calculating your credit score, but hanging on to an older credit card you still use and shows a strong payment history is a good idea.

The other aspect to consider is the average age of your accounts. This is determined by just adding the age of each account and dividing it by the number of accounts.

Let’s say you have four credit cards: one is 12 years old, one is 7 years old, one is 4 years old and the newest is one year old. If you add up those ages (12 + 7 + 4 + 1 = 24) and divide that by the number of cards (four) you get an average account age of six years.

As you can see, every new credit card or account you add will lower the average age. And a slew of new accounts will lower it very quickly. And as far as lenders are concerned, the older the age the better, so it’s a great reason to steer clear of opening new cards too often.

Stop overpaying for home insurance

Home insurance is an essential expense – one that can often be pricey. You can lower your monthly recurring expenses by finding a more economical alternative for home insurance.

SmartFinancial can help you do just that. SmartFinancial’s online marketplace of vetted home insurance providers allows you to quickly shop around for rates from the country’s top insurance companies, and ensure you’re paying the lowest price possible for your home insurance.

Explore better ratesBuilding a good score

One of the most important places to start when it comes to building and maintaining good credit is simply knowing what your credit score is.

There are sites that offer free credit monitoring, which is a great place to start getting into the habit of keeping an eye on it.

Maintaining a good credit history by keeping your balances low and making your monthly payments consistently. As you create a good payment track record, your credit score will gradually rise.

If you’re concerned that your credit score could use a bump in the right direction, there are also services designed to help you raise your FICO score.

And if your existing debt has you starting to feel swamped, [you should consider folding all of your debt into a consolidation loan with a lower interest rate.

- Credit building: If you need to build your credit up, there are dedicated credit-building services designed to help you do just that.

- Get a credit card designed to help you build your score: Provided you haven’t just just applied for or got a new credit card, you can sign up for a new card and get a jump on building your credit while enjoying benefits like no fees and cash back.

- Credit repair: Is your credit not where it should be and you need to put in the work to repair it? You can get a special credit-repair loan to help get your score back up.

Sponsored

Follow These Steps if you Want to Retire Early

Secure your financial future with a tailored plan to maximize investments, navigate taxes, and retire comfortably.

Zoe Financial is an online platform that can match you with a network of vetted fiduciary advisors who are evaluated based on their credentials, education, experience, and pricing. The best part? - there is no fee to find an advisor.