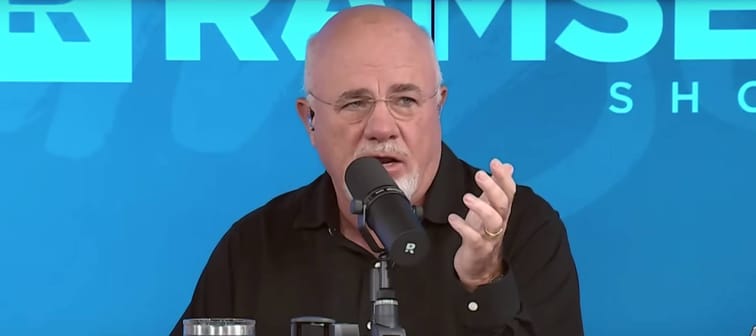

Buy and hold

On his blog, Ramsey recommends a long-term, buy-and-hold approach to real estate. This means purchasing a property at a fair price and waiting for it to gradually appreciate in value over time. It parallels how billionaire Warren Buffett invests in stock.

Historical evidence backs up this strategy. On average, U.S. real estate has appreciated at an annual rate of 4.4% since 1991. Some years have proven more volatile than others, with double-digit gains or losses. But over time, this volatility tends to even out. That’s why a buy-and-hold approach to real estate is often recommended.

This strategy is also easier than flipping. Investors simply need to value the property appropriately and make sure they pay a fair price — in part by reviewing comparable sales prices in a neighborhood and taking into account how much it may cost to repair and renovate it.

After that, all they need to do is maintain the property, pay taxes and insurance, and pay down the mortgage.

Meet Your Retirement Goals Effortlessly

The road to retirement may seem long, but with WiserAdvisor, you can find a trusted partner to guide you every step of the way

WiserAdvisor matches you with vetted financial advisors that offer personalized advice to help you to make the right choices, invest wisely, and secure the retirement you've always dreamed of. Start planning early, and get your retirement mapped out today.

Get StartedBuy and rent

Real estate investors can also rent a property out to tenants. This creates cash flow and enhances property value.

Being a landlord is lucrative in some parts of the country. The capitalization rate (that is, net operating income (NOI) divided by property value) can run as high as 10.18% in Greenwood, Miss,i, according to Mashvisor. That city ranks tops on its 2021 list of traditional cap rates by city in 2021.

Apartments in Ohio and Michigan can deliver comparable rates that range from 9% to 9.5%, according to Dataspot Analytics LLC.

Rental income is an excellent way to enhance the total return from your property investment. It’s also a long-term strategy because you can expect to receive it for the duration of your holding. But bear in mind it’s not exactly passive. To some extent, you’ll have to get involved in tenant affairs when something breaks or there’s a legal dispute involving rent.

That being said, with the help of some new investing platforms, it’s possible to become a landlord without all the tenant headaches. Through crowdfunding, you’re able to invest in institutional-quality commercial real estate investments that had previously been reserved for the ultra wealthy.

Some platforms even allow you to invest with as little as $100.

Reduce leverage

Ramsey recommends minimizing debt. In fact he believes, “paying off your home is the best way to invest in real estate.” This strategy makes more sense when interest rates climb, as we’re witnessing now. The average rate on a 30-year fixed mortgage is 6.81%. There’s no way to predict whether this rate will accelerate further or stay stagnant for several years, so investors can’t plan to refinance anytime soon.

Simply put, any new loan — whether for a new property or refinancing an existing one — could cost you thousands more in interest over the life of your loan. And that’s especially true if you were fortunate enough to lock down a mortgage rate back in the early days of COVID-19 when rates hit record lows.

For now, real estate investors would be wise to minimize their debt and set their eyes on more affordable homes.

Sponsored

Follow These Steps if you Want to Retire Early

Secure your financial future with a tailored plan to maximize investments, navigate taxes, and retire comfortably.

Zoe Financial is an online platform that can match you with a network of vetted fiduciary advisors who are evaluated based on their credentials, education, experience, and pricing. The best part? - there is no fee to find an advisor.