How she bought her home

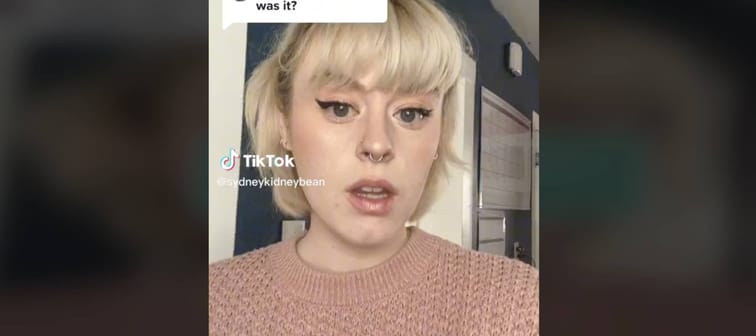

Bean secured a 3.375% mortgage — roughly half of the average rate now — and only pays $591 a month, she wrote in The New York Times.

She was able to get pre-approved for a $150,000 loan, thanks in part to her good credit score of around 750. She also had to leave her old job as a paraprofessional at an elementary school and found work in sales at a call center for $15 an hour in order to meet the income requirements.

Although the property was originally listed for $120,000, her real estate agent negotiated it down to $117,000 with an earnest money, or “good faith”, deposit of $3,000.

“The other thing that really helped me out in this process is I had that big chunk of cash so I could put forth over $20,000 as a down payment — which is a larger down payment than any of the other prospective buyers had,” Bean said in her video.

That left her with enough remaining to pay for additional costs like realtor fees and home insurance.

The now-24-year-old says she still owes about $90,000 on her mortgage and is “back to being poor,” but she and her Labrador huskies — Gaspard and Garbanzo — are very happy in their home.

Kiss Your Credit Card Debt Goodbye

Having a single loan to pay off makes it easier to manage your payments, and you can often get a better interest rate than what you might be paying on credit cards and car loans.

Fiona is an online marketplace offering personalized loan options based on your unique financial situation.

When you consolidate your debt with a personal loan, you can roll your payments into one monthly installment. Find a lower interest rate and pay down your debt faster today.

Get StartedHow to buy a home today — even if you haven’t won the lottery

Homeownership may seem like a feat nearly impossible for many young Americans facing the housing market today.

But here’s how you can still buy a home amid high mortgage rates (and without thousands of dollars in lottery winnings).

Fix your credit score

Bean says her 750 credit score helped her get approved for a mortgage — for reference, a score of 720 and up is considered excellent. A great credit score could potentially net you a lower rate on your home loan, so make sure to review your credit history and pay down debts to get yours up.

Build your savings

Start putting some cash aside each month to help with your future down payment and closing costs. The minimum down payment for a conventional loan is typically 5% of the purchase price, but experts recommend putting at least 20% down to lower your monthly mortgage bill.

Get a pre-approval

Bean got pre-approval on her home loan — a formal letter from a lender that verifies how much money you can borrow and at what interest rate. This can help prove to sellers and real estate agents that you’re a reliable buyer. It may even get you some negotiating power in the purchasing process.

Consider an all-cash offer

About one-third of home purchases were made in cash in April — with more buyers avoiding 6% rates and opting to pay in full instead. If you can afford a larger payment today, it could save you from making chunky monthly payments down the road.

Sponsored

Follow These Steps if you Want to Retire Early

Secure your financial future with a tailored plan to maximize investments, navigate taxes, and retire comfortably.

Zoe Financial is an online platform that can match you with a network of vetted fiduciary advisors who are evaluated based on their credentials, education, experience, and pricing. The best part? - there is no fee to find an advisor.