First-time homebuyer programs in Arkansas in 2021

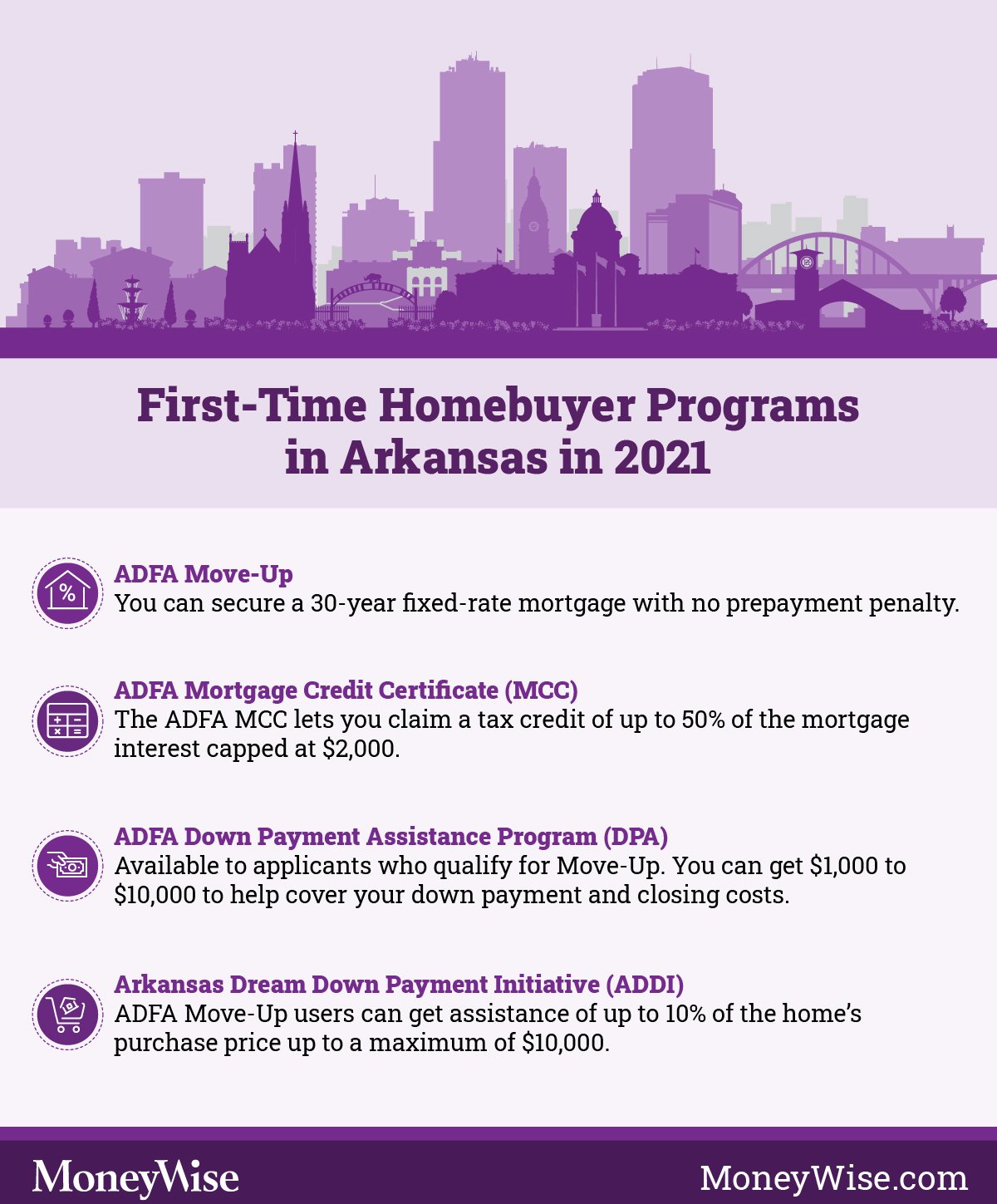

The ADFA has a number of programs for first-time homebuyers that will reduce your out-of-pocket expenses. For qualified applicants, the ADFA can help secure a mortgage, supply a tax credit certificate, provide funds for a down payment and more.

ADFA Move-Up

The ADFA’s Move-Up program offers first-time homebuyers affordable mortgages, whether that’s a conventional loan or through the FHA, VA or USDA. Working through an approved lender, you can secure a 30-year fixed-rate mortgage with no prepayment penalty.

Borrowers may be eligible to combine it with other ADFA single-family-home-buying incentives as well. However, there is currently a maximum purchase price of $421,100 for this program.

More: How to calculate maximum mortgage amount

ADFA Mortgage Credit Certificate (MCC) Program

A Mortgage Credit Certificate (MCC) is a dollar-for-dollar tax credit for first-time, low-to-moderate-income homebuyers. The certificate allows qualifying homebuyers to claim a tax credit of up to 50% of the mortgage interest they pay each year, capped at $2,000. As long as the home remains your primary residence, you can claim this credit for the life of the loan.

To qualify, you’ll need:

- To apply prior to closing your home loan.

- To be a first-time homebuyer, a veteran or the spouse of a veteran or purchasing a home in a targeted county referenced on the ADFA website.

- A household income below the set limit.

- To purchase a home for less than $270,000.

- To have the home as your primary residence.

- To use an approved lender. The savings can be substantial, but be aware that when you use an ADFA MCC, you’ll be charged an issuance fee of 0.5% of the loan amount.

ADFA Down Payment Assistance Program (DPA)

If you qualify for the ADFA Move-Up program, you can also apply for down payment assistance.

Qualified applicants receive between $1,000 and $10,000 to help with their down payment and closing costs. Cash back is allowed for expenses “paid outside of closing.”

Arkansas Dream Down Payment Initiative (ADDI)

Through ADDI, qualifying low-income Arkansans can get up to 10% of the purchase price of their home, up to a maximum of $10,000. This is technically considered a second mortgage but has no monthly payments and is normally forgiven over five years.

ADDI must be used with the Move-Up program. First-time homebuyers using ADDI may also qualify for the MCC.

Note, if you’re using ADDI or the DPA Program to purchase a home, ADFA will require you to take a pre-purchase homebuyer education course.

The Best Lenders for First-Time Homebuyers

See LendersStop overpaying for home insurance

Home insurance is an essential expense – one that can often be pricey. You can lower your monthly recurring expenses by finding a more economical alternative for home insurance.

SmartFinancial can help you do just that. SmartFinancial’s online marketplace of vetted home insurance providers allows you to quickly shop around for rates from the country’s top insurance companies, and ensure you’re paying the lowest price possible for your home insurance.

Explore better ratesWho qualifies for down payment assistance in Arkansas?

The ADFA’s programs are targeted at low- to moderate-income individuals and families looking to purchase a home in Arkansas. To qualify for these programs, you must fall below a set income threshold, pay your taxes and work with an approved lender.

Guide: How to Get a Free Credit Report and Score

Get My ReportNationwide first-time homebuyer programs

To get a “conventional” mortgage in the private market, you’ll often need a credit score of 620 and at least 5% of the price of the home for a down payment.

More: Use these savings accounts to build up your down payment.

Not everyone has a score that high or that much cash on hand. Luckily, the federal government has a number of nonconventional mortgage options that can help first-timers break into the market.

FHA loans

Federal Housing Administration (FHA) loans were created in 1934 to help more Americans become homeowners. At the time, fewer than half of American households actually owned their homes. Since its creation, the FHA has insured more than 46 million mortgages.

FHA loans typically have a minimum credit score of 580 and a 3.5% down payment, but if you put down more money upfront, you could qualify with a score as low as 500. Keep in mind, if your down payment is less than 10%, you’ll also have to pay a mortgage insurance premium.

VA loans

Congress passed the act that created these loans in 1944 with a goal to increase benefits to veterans. As a result, the U.S. Department of Veterans Affairs (VA) can guarantee or insure home loans made to veterans by a number of lending institutions.

VA loans are available to active service members, veterans and some surviving military spouses. Borrowers have to pay a funding fee but aren’t required to offer a down payment or pay mortgage insurance.

USDA loans

Similarly, USDA loans, which are targeted to lower-income rural and suburban Americans, don’t require down payments or private mortgage insurance. These loans are guaranteed by the United States Department of Agriculture.

Borrowers will have to pay an upfront 1% guarantee fee and an annual 0.35% fee with these loans, but that generally averages out to less than what you’d pay in mortgage insurance with another loan.

The USDA is pretty strict about who qualifies for these loans, income-wise. The current income limits in most parts of the U.S. are $86,850 for one- to four-member households and $114,650 for five- to eight-member households, but the thresholds may be higher if you live in a county with a steeper-than-average cost of living.

The USDA’s website allows you to search for the exact limits in your region.

Need cash? Tap into your home equity

As home prices have increased, the average homeowner is sitting on a record amount of home equity. Savvy homeowners are tapping into their equity to consolidate debt, pay for home improvements, or tackle unexpected expenses. Rocket Mortgage, the nation's largest mortgage lender, offers competitive rates and expert guidance.

Get StartedNext steps

Now you know what programs are out there to help you. But where do you even start?

Well, in almost every case your credit score is crucial. If you don’t know your score, a free service like Credit Sesame can help you find it.

Some of these programs have credit score requirements, but don’t despair if yours comes up short. There are some great options out there, like Self credit repair, that will help you get the score you need.

Next, collect all of your essential documents. You’ll usually need to show that you have money in the bank and a steady income.

Once you’re all set, getting pre-approved for a mortgage will give you an idea of what you can afford and the interest rates you’ll have to pay.

| Arizona | |

| Arkansas | |

| California | |

| Colorado | |

| Connecticut | |

| Delaware | |

| Florida | |

| Georgia | |

| Hawaii | |

| Idaho | |

| Illinois | |

| Indiana | |

| Iowa | |

| Kansas | |

| Kentucky | |

| Louisiana | |

| Massachusetts | |

| Michigan | |

| Minnesota | |

| Missouri | |

| Montana | |

| Nebraska | |

| Nevada | |

| New Mexico | |

| New York | |

| North Carolina | |

| Ohio | |

| Oklahoma | |

| Oregon | |

| Pennsylvania | |

| South Dakota | |

| Tennessee | |

| Texas | |

| Utah | |

| Virginia | |

| Washington | |

| Wisconsin | |

| Wyoming |

Sponsored

Follow These Steps if you Want to Retire Early

Secure your financial future with a tailored plan to maximize investments, navigate taxes, and retire comfortably.

Zoe Financial is an online platform that can match you with a network of vetted fiduciary advisors who are evaluated based on their credentials, education, experience, and pricing. The best part? - there is no fee to find an advisor.