Investing when times are tough

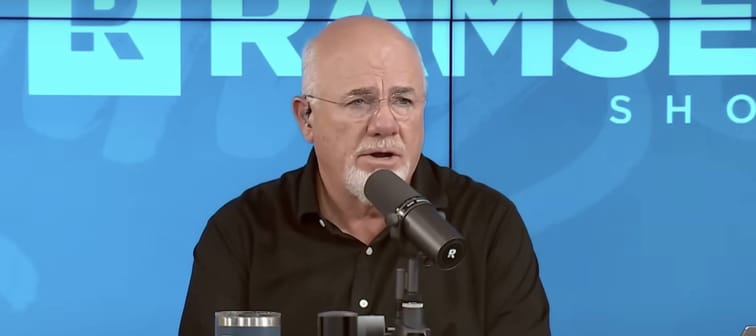

Ramsey goes one step further and recommends investing more when the market is down. He agrees with renowned investor Warren Buffett’s philosophy of being greedy when others are fearful. For example, he advocates for dollar-cost averaging, a strategy of investing a steady amount regularly, no matter the stock prices. This way you end up buying more when prices are low and gain more when the market recovers. The main advantage to this strategy is you lower your risk by not trying to time the market with lump sums.

Ramsey recalls the 9/11 attacks, which caused an immediate market panic. "I kept telling people, 'Look, buy, buy, buy. It's time to buy," said Ramsey.

Despite the initial shock, the market had rebounded by the following month. That's why he argues that buying stocks during such crises can be advantageous.

And experts who have crunched the numbers would agree. A review of 20 major geopolitical events dating all the way back to World War II showed stocks had fully recovered losses within an average of 47 trading days after an average maximum drawdown of 5%, according to a CFRA study cited by LPL Research.

Here's two examples of stock market resiliency after crises using the Dow index:

First World War: Stocks plunged with the onset and the market was closed for six months. "When they reopened, the Dow rose more than 88% in 1915. From the start of the war in 1914 until it ended in late 1918, the Dow gained over 43%—roughly 8.7% annually," according to Fortune.

Second World War: "From the start of World War II in 1939 until it ended in late 1945, the Dow was up a total of 50%, more than 7% per year," wrote Ben Carlson, director of institutional asset management at Ritholtz Wealth Management, in another Fortune article.

Meet Your Retirement Goals Effortlessly

The road to retirement may seem long, but with WiserAdvisor, you can find a trusted partner to guide you every step of the way

WiserAdvisor matches you with vetted financial advisors that offer personalized advice to help you to make the right choices, invest wisely, and secure the retirement you've always dreamed of. Start planning early, and get your retirement mapped out today.

Get StartedUnderstanding the risks and rewards

While this strategy has worked in previous cases, risks still exist, especially if conflicts escalate or recessions deepen. Maintaining a long-term mindset is key to successful investing, but you need to mitigate risks by diversifying across different asset classes, such as stocks, bonds and real estate. Investing in stocks during downturns can be rewarding long-term, especially if you’re a younger investor with time to recover from short-term losses. Having the courage and a contrarian mindset to capitalize on market fears can pay off.

Control what you can, accept what you can’t

Social media and the 24/7 news cycle can make you nervous and afraid, but Ramsey’s co-host, Jade Warshaw, reminds us to focus on what we can control and accept the things that we can't control.

Ramsey’s suggestions may not be suitable for everyone, but usually align with historical trends of market recovery post-crisis. A well-anchored investment plan based on market principles and rational allocation strategies is advisable. It’s also important to focus on what you do have some control over, such as debt elimination and putting away savings regularly. This will help you keep progressing, even when the markets are tough.

Sponsored

Follow These Steps if you Want to Retire Early

Secure your financial future with a tailored plan to maximize investments, navigate taxes, and retire comfortably.

Zoe Financial is an online platform that can match you with a network of vetted fiduciary advisors who are evaluated based on their credentials, education, experience, and pricing. The best part? - there is no fee to find an advisor.