Here’s our no-stress guide to filing your taxes — and getting it right — if you've never done it before.

Understanding taxes

Your income tax is a portion of your earnings that must be paid to the federal government under the 16th Amendment to the Constitution. Your state likely requires you to pay income tax too, though a few states don't.

Income taxes are used to fund government programs and services, including the U.S. military, law enforcement, education, health care and Social Security. Some of the money also goes toward interest on the national debt.

How much you pay in taxes depends on:

-

Your taxable income: Earning a higher income puts you in a higher tax bracket, and the result is you pay a larger overall tax percentage on your earnings. With tax brackets, higher chunks of taxable income are taxed at higher rates as your earnings rise. For example, if you're single you pay: 10% on the first $9,950 of taxable income; 12% on the next $9,951 to $40,525; 22% on the next portion, up to $86,375; and so on. The highest of the seven current brackets taxes any income portions over $628,301 at a 37% rate.

-

Your filing status: There are five, and you'll need to pick one: single; married filing jointly; married filing separately; widow or widower with a dependent child; and "head of household,” which means you're unmarried, have at least one dependent and pay more than half the household expenses.

-

Your age: The federal government offers special tax breaks at certain ages. For example, workers younger than 19 and full-time students under 24 may report their earnings on a parent's return — potentially saving on taxes. Senior citizens get a special tax credit.

-

Other factors: What you owe can be affected by whether someone else is claiming you as a dependent, plus any tax savers you're able to claim, such as deductions and credits.

Meet Your Retirement Goals Effortlessly

The road to retirement may seem long, but with WiserAdvisor, you can find a trusted partner to guide you every step of the way

WiserAdvisor matches you with vetted financial advisors that offer personalized advice to help you to make the right choices, invest wisely, and secure the retirement you've always dreamed of. Start planning early, and get your retirement mapped out today.

Get StartedHow to file your very first tax return

The process is much simpler than it used to be thanks to today's consumer-friendly tax software. The software generally asks a series questions and fills out your tax return automatically, using the information that you provide.

The software providers typically charge a fee to file your return.

Your return is filed electronically to the IRS and can be accepted by the tax agency within 24 hours. If you have a refund coming, you typically should receive it in under three weeks — even less time if you get it by direct deposit. But the IRS has a backlog of returns to process from the pandemic and says to expect refund delays in 2022.

An alternative is to use the IRS' "fillable forms" that can be completed and filed electronically, though there are limitations that might require you to print out and mail in your return.

The IRS says an estimated 6% of taxpayers still mail their returns, including some who choose to go completely old-school by filling out a paper tax form by hand. In that case, your refund typically can take six to eight weeks.

Those with complicated returns or busy schedules hire professional tax preparers to do their taxes. Whichever route you choose, you'll want to follow these steps the first time — and every time.

1. Know your filing status.

If you're single, your filing status is obvious. If you've lost your spouse in recent years and are supporting a child, you'll want to file as a "qualified widow or widower."

Most married couples will benefit from filing jointly. High-income couples and spouses who suspect their partners are concealing income or have potential tax problems may want to file separately.

Whether to file as a head of household can be a little tricky. If you qualify — that is, you're not married, are supporting others and are carrying most of the financial weight in your household — the tax savings can be substantial.

2. Gather the required documentation.

Gather documents of your expenses and earnings.

You'll need to have or know:

-

Your Social Security number.

-

Your W-2 form(s). A W-2 is the annual "wage and tax statement" that your employer is required to provide by Jan. 31.

-

1099 form(s). Each 1099 is a record showing that you were paid money by a person or entity other than an employer — for example, if you received payment for freelance work, or if you earned interest on a savings account. You might not have to pay tax on these amounts, but you do have to include them when you file.

-

The amount of your retirement account contributions. Up to $6,000 put into a traditional IRA can be deducted from your taxable income in 2019 and 2020 if you're younger than 50. If you're 50 or older, you might be able to write off up to $7,000.

-

Whether you had educational expenses. Student or their families may be eligible for tax credits of up to $2,500 for qualified expenses, such as tuition and fees.

-

If you had unreimbursed medical bills. Certain medical expenses can be deducted if they added up to more than 7.5% of your adjusted gross income. So if your adjusted gross income is $40,000, then you can deduct anything you spent above $3,000.

-

Any amounts you paid in property taxes and mortgage interest. If you itemize deductions — and we'll explain that shortly — the taxes can be written off within limits, and interest on a mortgage or home equity line of credit often can be deducted too.

-

Whether you paid for classroom expenses out of your own pocket. Teachers can claim up to $250 spent on classroom supplies and related items.

-

Records on charitable contributions you made. These can be deducted as long as you have documentation, such as a receipt from the charity, to show that you donated money or items. You have to itemize your taxes to get this deduction, but for the 2021 tax year, the government is allowing up to $600 in donation deductions for couples filing jointly without itemizing.

-

The amounts you paid in state and local taxes.

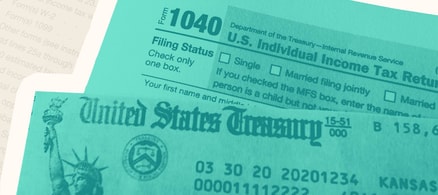

3. Use the right tax forms.

The primary tax form is the 1040.

The main one you’ll need is Form 1040, which you’ll use to disclose your income and claim tax deductions and credits. This form also will help you calculate your refund or the amount of any taxes you owe.

However, you might need to use some other forms: if you want to itemize deductions (Schedule A); report taxable interest or dividends above $1,500 (Schedule B); report profits, losses and expenses from freelancing gigs (Schedule C); add up your gains and losses from investing in stocks, bonds and more (Schedule D); or deduct mortgage interest payments above $600 (Form 1098).

If you hire a good tax pro or use tax software, you won't have to worry about getting your hands on any forms.

4. When is Tax Day 2024?

While the deadline to pay your tax bill is in April, it's best to get ahead of the game. The IRS charges a 0.5% late payment penalty every month after the deadline up to a maximum of 25%.

In 2024, taxes for 2023 must be paid by Monday, April 15, 2024.

5. Decide: Take the standard deduction or itemize?

Deductions decrease your taxable income and help lower your tax bill. You have the option of itemizing your deductions — which means listing them out one by one — or taking a simplified, standard deduction.

An estimated 90% of U.S. households now take the standard deduction thanks to the 2017 tax law that nearly doubled the standard deduction amounts.

Your standard deduction is determined by your filing status.

| Filing status | Standard deduction |

|---|---|

| Single | $12,950 |

| Married, filing jointly | $25,900 |

| Married, filing separately | $12,950 |

| Qualifying widow or widower | $25,900 |

| Head of household | $19,400 |

Avoid these tax-filing mistakes

Newbies and even veteran tax filers make common errors that can hold up a tax refund or trigger a dreaded audit from the IRS.

Not filing. If you're a single filer under 65 and made more than $12,950 in 2022 you must file an income tax return. If you don't file, not only are there potential penalties, but you also could also miss out on a refund if your employer withheld income tax from your pay.

Filing a return without having the required documents. If you don’t report your income and expenses correctly, you may wind up paying more or less than you should.

Even worse, if the IRS audits you and finds a mistake in your taxes, you could be charged an additional 20% penalty on top of any taxes you owe.

Not filing under the correct status. Filing under the wrong status can be costly. For example, if you’re a single parent with a dependent child, it can be ill-advised to file under the "single" status, which has a $12,950 standard deduction. Filing as a head of household — if you qualify — would get you a better standard deduction of $19,400.

Not itemizing when you can. If you've had a lot of expenses or are self-employed, itemizing could be a smarter choice than going with the standard deduction. Things like medical bills, mortgage interest and charitable donations could add up to a significant amount when itemized.

Not reporting all of your income. If you earn money from a side hustle, not reporting the income could result in problems with the IRS — and you wouldn't be able to claim related expenses that could lower your tax payment. For example, Uber drivers can deduct car operating expenses, such as gas, oil, insurance, repairs and more.

Filing taxes on your own if you’re not sure how. When you file taxes your incorrectly, you can lose money and run into issues with the IRS. If you need help, go to a professional — the fee is usually worth it to file your taxes correctly. And again, today's tax software makes the process easier.

Sponsored

Follow These Steps if you Want to Retire Early

Secure your financial future with a tailored plan to maximize investments, navigate taxes, and retire comfortably.

Zoe Financial is an online platform that can match you with a network of vetted fiduciary advisors who are evaluated based on their credentials, education, experience, and pricing. The best part? - there is no fee to find an advisor.