High returns, low fees

This decade-long bet challenged the notion that complex and expensive investment methods always yield the best results.

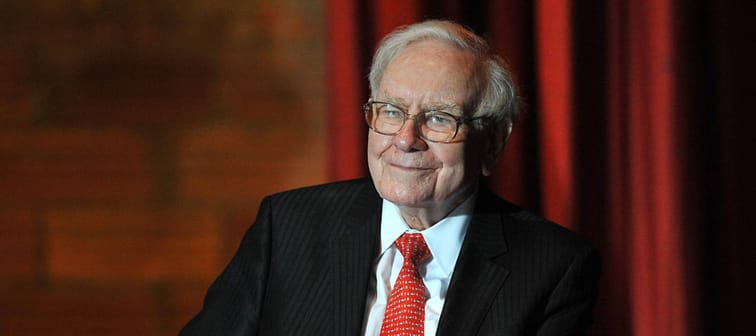

After all, anyone can replicate Buffett’ strategy at a very low cost. The Vanguard index fund he picked has an expense ratio of just 0.04%.

The hedge funds, Buffett pointed out, come at a much higher cost to investors.

“Even if the funds lost money for their investors during the decade, their managers could grow very rich,” he wrote in the shareholder letter. “That would occur because fixed fees averaging a staggering 2.5% of assets or so were paid every year by the fund-of-funds’ investors, with part of these fees going to the managers at the five funds-of-funds and the balance going to the 200-plus managers of the underlying hedge funds.”

In the investing world, fees should not be overlooked — they can eat into your returns. In an op-ed for Bloomberg titled “Why I Lost My Bet With Warren Buffett,” Seides agreed with Buffett on the subject of hedge funds’ management fees.

“He is correct that hedge-fund fees are high, and his reasoning is convincing. Fees matter in investing, no doubt about it,” he wrote.

These days, many ETFs enable investors to track benchmark indices at minimal costs. For instance, the Vanguard S&P 500 ETF (VOO), which follows the S&P 500, has a low expense ratio of 0.03%. Similarly, the SPDR S&P 500 ETF Trust (SPY) tracks the same index and carries an expense ratio of 0.0945%.

Does that mean every investor should abandon stock-picking and put all their money into index funds?

The answer varies based on the individual.

For someone like Buffett, making their own investment decisions could lead to significantly greater success. Consider this: from 1964 to 2022, Buffett’s Berkshire Hathaway delivered an astounding overall gain of 3,787,464%, substantially outperforming the S&P 500’s already impressive 24,708% return in the same timeframe.

Sponsored

Follow These Steps if you Want to Retire Early

Secure your financial future with a tailored plan to maximize investments, navigate taxes, and retire comfortably.

Zoe Financial is an online platform that can match you with a network of vetted fiduciary advisors who are evaluated based on their credentials, education, experience, and pricing. The best part? - there is no fee to find an advisor.