Best online stock brokers for 2024

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Please be aware that some (or all) products and services linked in this article are from our sponsors.

Updated: January 04, 2024

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Please be aware that some (or all) products and services linked in this article are from our sponsors.

The best online stock brokers offer opportunities to invest in the assets you want with the lowest fees possible. Some offer automated and assisted investing, while others are specialized for do-it-yourself (DIY) investors.

To help you pick the best online stock broker for your unique investment needs and goals, we took a look at the most popular brokerage firms around to help you zero in on the right investment company for 2024 and beyond.

Best online stock brokers at a glance

- Interactive Brokers – Best for Active Traders

- E*TRADE – Best for Fee-Free Mutual Funds

- Robinhood – Best for Low-Cost Options Trading

- Fidelity – Best for Retirement

- M1 Finance – Best for Automated Investing

- SoFi – Best for Beginners

Interactive Brokers – Best online broker for active traders

Interactive Brokers

Quick Facts

Our score: 4.3

Minimum investment: $0

Stock/ETF trades: $0 for IBKR Lite; $0.0005 – $0.005 for IBKR Pro ($1 min; 1% max)

Options: $0 + $0.65/contract (discounts available for low premium trades)

Current promotions: None

What makes it great: Interactive Brokers is powerful enough for Wall Street investors managing institutional investment accounts. As an individual trader using the IBKR platform (the consumer version). IBKR Lite and IBKR Pro come with different pricing better suited for different types of investors, but mostly similar features.

The trading platform is top-notch and could make you feel like you’re in a fast-paced movie about the stock market. It supports a huge number of investment types with competitive pricing. It offers investor APIs, bots, and automations. This firm can meet the needs of any expert investor.

Potential drawbacks: IBKR may seem a bit overwhelming for beginners. With so many trading features and tools, the more complex platform is best for those with experience who intend to maintain their investment accounts actively.

Commissions and fees: IBKR Lite includes most features with no recurring fees or commissions for most orders. Fixed options trades cost $0.65 per contract with a $1 minimum. IBKR Pro has a more complicated pricing structure and is best for highly active traders.

Pros

- Professional-quality trading platforms for desktop and mobile

- Trade a huge number of supported asset types, including cryptocurrencies

- Low fees with IBKR Lite

Cons

- Several pricing models with varying complexity and fees

- Trading platforms may be overwhelming for some investors

Our Interactive Brokers review

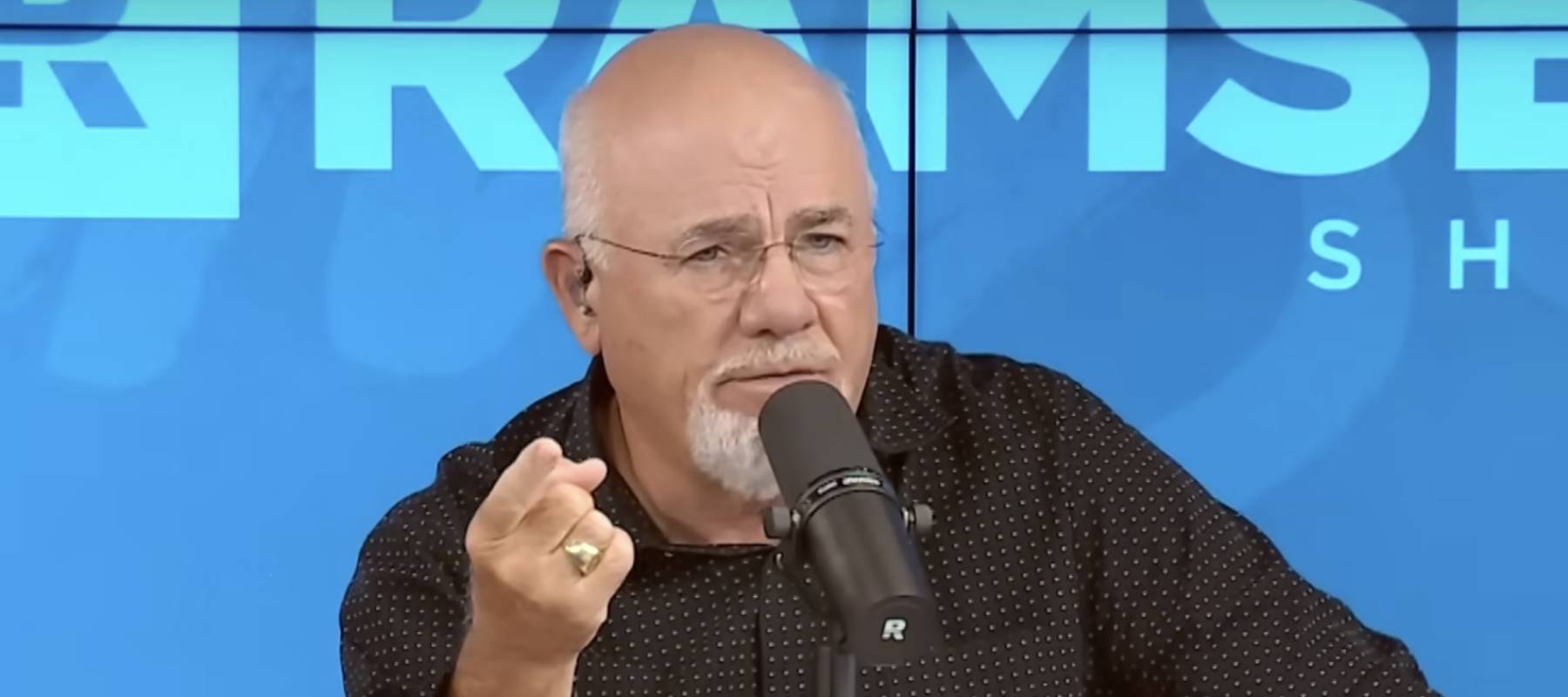

E*TRADE – Best online broker for fee-free mutual funds

E*TRADE

Quick Facts

Our score: 4.8

Minimum investment: None

Stock/ETF trades: $0

Options trades: $0 + $0.65/contract ($0.50/contract with 30+ trades per quarter)

Current promotions: Open and fund & get up to $600 or more.

What makes it great: E*TRADE offers 4,000+ no-load, no-transaction-fee (NTF) mutual funds. That's one of the largest lists of free funds that you'll anywhere today. E*TRADE has a beginner-friendly platform as well as a robust trading platform, called Power E*TRADE. Both platforms are easy to use on mobile.

As a full-service brokerage, E*TRADE offers investments in stocks, ETFs, options, bonds, and futures. You can choose to open a regular, taxable brokerage account or an IRA, Individual 401(k), or Profit Sharing Plan. And E*TRADE also offers a robo advisor service, called E*TRADE Core Portfolios that's available to clients with balances of at least $500

Potential drawbacks: It's honestly hard to find things to complain about with E*TRADE. But if we're being picky, the lack of support for fractional share trading may disappoint some traders, especially those with smaller account balances. Also, you'll need to look elsewhere if you're wanting to trade crypto in addition to stock market assets.

Commission and fees: Stock, ETFs, and options trade commission-free at E*TRADE. There's a per-contract options fee that starts at $0.65 but reduces to $0.50 if you make more than 30 trades per quarter. Futures cost $1.50 per contract and E*TRADE's Core Portfolios come with an annual advisory fee of 0.30%.

Pros

- Comprehensive trading platform

- User-friendly interface

- Accommodates investors of different levels

Cons

- No fractional share trading

- Oriented towards active traders for options

Sign up to E*TRADE | E*TRADE review

Robinhood – Best for low-cost options trading

Robinhood

Quick Facts

Our Score: 4.3

Minimum Investment: $0

Stock/ETF Trades: $0

Options: $0

Current promotions: Free stock

What makes it great: When Robinhood launched in 2013, it disrupted the industry with its commission-free stock trading. Today, that's basically the price of admission if you want to be competitive as an online stock broker. However, options trading is one area where Robinhood still undercuts most of its competitors. Not only does it charge no commissions on options, but it doesn't charge any per-contract fees either.

Robinhood is optimized for mobile and active traders, though it could also work for long-term investors looking to avoid fees standard at other online share trading centers. Customers can optionally upgrade to Robinhood Gold for $5 to access additional features, including margin borrowing and instant deposits up to $50,000. And unlike several names on this list, Robinhood also supports crypto trading – although at present only seven coins are tradable on the platform.

Potential drawbacks: Robinhood doesn’t support mutual funds, which is a drawback for some investors. It also requires a $5 monthly charge for all market data and research access. The biggest drawback of Robinhood is a history of outages and regulatory missteps that you should research for yourself before signing up.

Commissions and fees: Robinhood doesn’t charge any commissions or fees on trades. The only fee customers can incur is an optional $5 monthly charge for Robinhood Gold, It should also be mentioned that Robinhood relies on the somewhat controversial practice of receiving Payment For Order Flow (PFOF) to monetize its clients' trading activity in lieu of charging commissions.

Pros

- No commissions or fees for regular use

- Trade stocks, ETFs, options, and cryptocurrencies

- Optimized for active, mobile traders

Cons

- No mutual funds

- History of brief outages and regulatory troubles

Sign up to Robinhood | Our Robinhood Review

Fidelity – Best online broker for retirement

Fidelity Investments

Quick Facts

Our score: 4.5

Minimum investment: $0

Stock/ETF trades: $0

Options: $0 + $0.65/contract

Current promotions: $100 bonus when you deposit $50 into your new account

What makes it great: Fidelity is another of the biggest online stock brokers in the United States that makes it easy to manage all of your investments under one roof. However, Fidelity stands out from the rest for its retirement accounts and related features. If your main goal is long-term investing, Fidelity could be the best choice.

In addition to low fees accounts, Fidelity offers a set of no-fee ETFs, meaning you can make a broad investment that’s almost truly no cost. It also supports multiple trading apps for various investment types and goals. The retirement analysis tools are also some of the best around and are free for all customers.

Potential drawbacks: Fidelity doesn’t give us much to complain about. But it should be noted that it doesn't support certain less common assets like futures or crypto. It also charges a relatively high fee for assisted trades, but that’s not out of the norm among peers. Expert active traders may also find Fidelity’s platforms limiting compared to others.

Commissions and fees: Fidelity mainly offers accounts with no recurring fees. You won’t pay commissions on most trades outside of fixed-income securities and a $0.65 cent per contract fee for options. Fidelity also features four index mutual funds with 0% expense ratios. Broker-assisted trades will set you back $32.95.

Pros

- Low-cost accounts and commission-free trades

- Excellent resources for retirement planning

- Several apps to manage your accounts and investments

Cons

- Clients can't trade cryptos or futures

- High cost for assisted trades

- Less ideal for some active, expert traders

M1 Finance – Top stock broker for automated investing

M1 Finance

Quick Facts

Our score: 4.3

Minimum investment: $0

Stock/ETF trades: $0

Options: N/A

Current promotions: $75 to $500 bonus when you fund your account within 14 days, depending on how much you deposit

What makes it great: M1 offers a suite of tools that are perfect for automated investors, including experts who want to maintain a specific portfolio and beginners who want a primarily hands-off experience. It is also notably fee-free for most investing needs outside of some investment-specific management fees.

The highlight of M1 is its portfolio experience, which is managed using an interface called Pies. You can choose an expert-curated Pie or customize your own. The system works to keep your portfolio balanced to that target allocation, including stocks and ETFs. It supports several popular account types and offers banking and lending products in addition to its flagship investment product.

Potential drawbacks: Some features are limited to M1 Plus program members, costing $125 per year. M1 Plus unlocks a second daily trade window (by default all trades go in one batch in the morning), smart transfer rules, and more favorable rates for banking and loan products. M1 Plus is required for custodial accounts. It only supports a limited set of investment assets, with no mutual funds, cryptocurrencies, or options.

Commissions and fees: M1 doesn’t charge any trading commissions or recurring account fees unless you opt-in for M1 Plus at $125 per year. There are some fees for less-common activities and inactive accounts with a balance of $20 or less.

Pros

- Semi-automated investing with portfolio Pies

- Choose expert-curated portfolios or customize your own

- No commissions or ongoing fees for most accounts

Cons

- $125 annual subscription is required to unlock all features

- No mutual funds or cryptocurrencies

Read our M1 Finance review

SoFi – Best online stock broker for beginners

SoFi

Quick Facts

Our score: 4.3

Minimum investment: $0

Stock/ETF trades: $0

Options: N/A

Current promotions: Up to $1,000 in stock when you fund your account with at least $10 within 30 days of opening (not guaranteed)

What makes it great: SoFi is an excellent website to trade stocks for newly active traders. Any digital native, from Gen X to Gen Z, will likely find it intuitive and easy to use even if they've never invested in the past. It makes investing in stocks and ETFs very easy and includes commission-free trades and no recurring account fees.

In addition to a beginner-friendly trading platform, it offers a robo-advisor with no added costs or fees. It also supports cryptocurrency trades and an excellent low-fee banking platform, among other useful financial products and services. The settings for automated, recurring investments are one of the best around, with options for daily, weekly, and different schedules for fractional purchases of any supported stock, ETF, or cryptocurrency.

Potential drawbacks: It supports most common trading and investing needs but doesn’t cover every type. For example, you can’t hold mutual funds at SoFi, and you won’t find every stock on the markets. The types of accounts you can open are also limited compared to some larger online stock brokers.

Commissions and fees: Many users will find the SoFi investing experience completely fee-free, with no commissions and no recurring account fees. There’s a cost for cryptocurrency trades, deducted from orders automatically.

Pros

- Easy-to-use trading app

- Almost no costs or fees

- Covers most common investing needs

- Support for cryptocurrencies

Cons

- Limited account and investment types

- High cryptocurrency trade cost

Read our SoFi Active Investing review

Other notable online stock brokerages

Here are a few more online stock brokers that just missed the cut for our “best of” list but may have specific features that appeal to you:

- Ally Invest: Ally Invest offers both self-directed and automated investing and its options trading platform is one of the most advanced and affordable (options trade for just $0.50 per contract) on the market today. Read our Ally Invest review.

- TradeStation: TradeStation is a top online share trading center for expert, active traders who want a professional-style investment experience. Read our TradeStation review.

- Webull: Like Robinhood, Webull supports crypto in addition to stocks, ETFs, and options. But Webull's trading platform is more advanced and provides an impressive array of technical analysis tools. Read our Webull review.

- Firstrade: Firstrade offers a little something for everyone, with a wide range of supported investments and account types with very low fees. Read our Firstrade review.

- Public.com: Public.com allows users to trade fractional shares of stocks and ETFs and also supports crypto trading. The platform also has social features like the ability to make your trades “public” and learn from other traders in your feed. Read our Public.com review.

- Vanguard: Vanguard has long been one of the best online stock brokers for passive investors. This is thanks to its low-cost index funds and the rock-bottom advisory fees that it charges for Vanguard Digital Advisor and Vanguard Personal Advisor services. Read our Vanguard review.

- Merrill Edge: Merrill Edge could be a great choice for Bank of America (BOA) customers since those with eligible BOA checking accounts can enroll in Preferred Rewards to earn up to a 0.15% discount on Merrill Edge Guided Investing as well as other perks.Read our Merrill Edge review.

- JP Morgan Wealth Management: Investors can use JP Morgan Self-Directed Investing for commission-free online trading for mutual funds, stocks, and ETFs. The company also has a robo-advisor if you prefer. Read our J.P. Morgan Self-Directed Investing review.

- Disclosure: INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT • NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

How did we choose these stock brokers?

In selecting these investment tools, we had the requirement that they must help:

- Increase your investment returns, OR

- Decrease your expenses, OR

- Improve your asset allocation

We've created the following as a shortcut for your investing needs, but this doesn't mean we didn't fully test out these services. With most of the brokerage accounts listed, we've done an in-depth review. So please also read the full review to find out why these services are on our recommendation list.

How to choose the top online stock brokerage companies

Choosing the right stock broker for you depends on your particular trading style and goals. So we've compiled these factors to help you choose:

- 1.

Cost Per Trade — Be sure to investigate all costs. Don't get tempted to the lowest commission per trade. Look at fund fees if you're investing in ETFs or mutual funds, as well as any hidden fees like for assisted trades.

- 2.

Minimum Initial Investment Required — Choose an online stock broker with no required minimum or one that requires only a few hundred dollars to start investing.

- 3.

Types of Retirement Accounts Available — Confirm what kind of accounts they offer before you sign up. Do they offer an IRA, a rollover IRA or just traditional taxable accounts?

- 4.

Proper Asset Allocation Guidance — Find a broker that offers asset allocation with a minimum additional charge. For example, if you choose a robo-advisor, check to see how their portfolios are invested to see if they are diverse enough for your needs.

- 5.

Easy-to-Use Website — Make sure the platform is easy to use and that all fees are clearly defined. You can read our article on the best investment apps for beginners for some of our favorite picks.

- 6.

Direct Investment Advice — Be sure to choose a service that provides a full investment advisory service.

- 7.

Access to Investment Research — Find a discount broker that offers research papers for free.

Get the full, in-depth, criteria list here.

Is stock trading safe?

Generally speaking, it's safe to trade stocks online. But that doesn't mean you'll never be affected by threats. Online stock brokers are doing all they can to minimize those threats.

But as a responsible online trader, you also have to do your part to implement your security measures. Review your broker's security measures, implement your own, and use common sense when trading, and you should come out unscathed.

What are the risks of online trading platforms?

Unfortunately, there are several risks involved when you trade stocks online, just as is the case anytime you engage in any internet-related activity. Some of the more common ones include:

- 1.

Identity theft. What's not always fully appreciated is the degree to which identity theft is an inside job. It makes perfect sense. People inside an organization have access to your information. When you trade stocks online, the potential is real for an insider to compromise one of your most valuable asset accounts.

- 2.

Computer viruses and malware. Often the main purpose of viruses and malware is to install spyware on your computer. Thieves can use this to gain access to your passcodes and other information. One way they do this is by installing spyware that enables them to engage in keylogging. This allows thieves to track your keystrokes, giving them access to valuable information.

- 3.

Data breaches. There were a record 1,862 data breaches in 2021. That represents an increase of 68% over 2020. To make matters worse, major financial institutions are a treasure trove of valuable information which makes them a gold mine for cyber hackers.

- 4.

Phishing schemes. Thieves have become adept at duplicating official-looking documentation from different financial institutions. In fact, they can copy a webpage or email with exact precision. You can receive a convincing-looking email from what looks like your online broker. But it's really just a copy, directing you to log into your account by clicking a link. But the link doesn't go to your online broker. It goes to a duplicate webpage that's designed to collect your passcodes. Your real account then becomes immediately vulnerable.

How online brokers protect you in the trading process

Virtually all online stock brokers maintain strong security procedures to protect you while you're accessing your account. As well, companies and security experts regularly monitor the online environment for new threats. Most threats, old and new, will be stopped by your broker's security measures.

Common broker security measures include:

- Secure sockets layer (SSL) encryption. This typically includes the use of a 128-bit key to encrypt and decrypt data files. In fact, 128-bit encryption is generally considered unbreakable. It would require a massive computation that could take thousands of years to break.

- Secure servers. Encrypted data is stored behind secure and monitored firewalls, in fully secured facilities.

- Two-step authentication. This feature is an additional login step, over and above your passcodes. It would be best if you took advantage of this step — see below.

- Automatic logout. Your account is set up to automatically log out of your secure session following a period of inactivity. For example, after 10 minutes of inactivity, the platform may ask you if you wish to continue. If you don't respond, it automatically logs you out of your account.

- System monitoring. The financial institution regularly monitors its entire system for potential security breaches and other threats such as malware, fraudulent apps, and phishing schemes.

What you can do to protect yourself while using online stock brokers

Even with the best broker-implemented security measures in place, your account can never be completely safe without your cooperation. It would be best if you took the necessary precautions to protect yourself:

- Install good anti-virus and anti-spyware programs on your computer. This will be your best protection against viruses, malware, spyware, and other online threats. It's also important to make sure your security programs are regularly updated.

- Use strong passcodes. Most people create passcodes that are user-friendly. There's a strong preference for passcodes that are easily remembered. Even worse, many users employ the same passcodes across several financial websites. Rather than using easy-to-remember passcodes, create the type that makes no sense at all.

- None of the words or numbers in an effective passcode should be easily connected to you personally. That means don't use family names, street addresses, or common numbers, such as your phone number or your date of birth. Use a mix of both uppercase and lowercase letters, numbers, and symbols. It will be less convenient for you, which is exactly why it will be much harder for hackers.

- Participate in two-factor authentication. This adds another layer beyond your passcodes. Many financial institutions make two-factor authentication available to you. It would be best if you always took advantage of it. It requires you to enter a verification code after entering your passcodes. Your trading app will send you the code by either email or text, and you then type that code to gain access to your online account.

- Guard your account information. Be aware of who's around when you're logging into your account. Never leave your computer unattended when you're logged in. Log out of your account immediately after you're finished. And never leave account documentation where anyone else might find it.

More: Best stock trading apps and platforms for day trading for 2024

How to choose an online stock broker

Here at Moneywise, we like to think we know a thing or two about stock brokers. After all, we've logged in countless hours test-driving them, and we regularly publish and update in-depth reviews with our findings. Here are the aspects we analyze when we review, rate, and choose an online stock broker.

1. Cost per trade

Cost per trade is something of the holy grail of the online brokerage universe. Since it's a number, it can be easily compared with competitors. But you have to be careful not to rely on a single cost, such as stock trade cost since brokers typically have a wide assortment of fees.

Be sure to investigate all costs. Though one broker may have the lowest commission per trade on stocks, that will do you little good if you mostly trade options or invest in mutual funds, where the commissions may not be so attractive.

For help in determining across-the-board fees at popular online brokerage firms, check out our online broker comparison list. It provides an unbiased side-by-side comparison of the most typical fees charged by the major firms.

2. Minimum initial investment required

Most brokers have a minimum initial investment requirement, which may be many thousands of dollars. If you are a new investor, with little or no investment capital, it may not matter if a broker is the best in the industry if you can't meet the required minimum account deposit.

Some brokers have no minimum requirement or require only a few hundred dollars. Some large online brokers have no required minimum initial investment, when Ally Invest is the biggest one (and the best, to our opinion).

3. Types of retirement accounts available

Most top stock brokers offer multiple types of retirement accounts to invest in, but it's best to confirm this at the very beginning. Even if you want only a regular investment account right now, you may want to open an IRA or Roth IRA in the future. You may also decide you want to open a custodial account for one of your children or a 529 account for their college funds.

Confirming these options exist before you first sign on can save you a serious research job in the future. Also, most investors like to have all of their various accounts with a single broker, particularly if they are happy with the service.

4. Proper asset allocation guidance

Asset allocation is one of the more challenging investment functions for many people, especially for new investors. It can be complicated enough to decide on initial asset allocation, but even more, involved to maintain that allocation going forward. This will require periodic rebalancing, which is not the easiest of tasks if it must be done manually.

If this is a concern, you will need to find out if the broker offers this service and if there is an additional charge. Most robo-advisor services will handle asset allocation — and automatic rebalancing — as part of their account management fee. If you're looking for “hands-off” investing, robo advisors could be the best option for you.

5. Easy-to-use website

In my opinion, a brokerage's website is one of the most important considerations. Low commissions are great, but what if the platform is confusing to use? If it takes ten steps to execute a trade, is it worth using the broker? On the other hand, more experienced day traders prefer to use more complicated platforms akin to the Bloomberg Terminal. However, a platform with all those bells and whistles should still be useable.

6. Direct investment advice

With the trend in online investing, DIY (do it yourself) investing has become the buzz phrase. But what if you're not a DIY investor and have no interest in becoming one? This is where you'll have to determine if a broker provides any direct investment advice and if there is any charge for the service.

Some stock brokers will offer limited investment advice, while others will provide a full investment advisory service, usually for a small fee. Still, others may charge you for advice on an as-needed basis. One example of this is when you want to make a broker-assisted trade. Some firms will charge a higher transaction fee if you require broker assistance.

It's important to understand that a major reason brokers can charge low transaction fees is precise that they offer little or no human assistance. If you want that kind of advice or assistance, be sure to investigate the availability at any firms you are considering, and be aware that it is very likely to change the pricing structure.

7. Access to investment research

Access to investment research via your broker is not only convenient but also can save you money. Purchasing stock and mutual fund research can be costly. A discount broker offering research papers for free is something to consider in reducing your trading expenses.

8. What investment options are available? (i.e., stocks, bonds, mutual funds, ETFs, options, forex)

A good broker is one that offers you the ability to invest in a large number of assets:

- Stocks

- Bonds

- Mutual Funds

- Exchange-Traded Funds (ETFs)

- Real Estate investment trusts

- Options

- Futures

- Certificates of Deposit

- U.S. government Treasury securities

Even if you only want to invest in ETFs right now, you have to consider the possibility you may want to spread your investment wings in the future. For that, you will need a broker who can provide you with all of the possibilities.

Related: How to diversify your investment portfolio

9. Does this online broker they have ethical investing options?

If you're interested in ESG investing, also known as sustainable investing, you'll need to take that into account when looking for a stock broker. While you can certainly research and buy stocks that are ESG yourself, there are also places that do all the research for you. For example, Aspiration offers an ESG investing option.

10. Interest on uninvested funds

Though most brokers do offer interest on uninvested funds — usually at money market levels — not all do. That's easy to overlook when interest-bearing investments pay less than 1%, but it will become more important when interest rates rise to higher levels.

11. Third-party referrals

Before signing up with any broker, get opinions from people who either are currently invested with that firm or have been in the past. No matter how convincing a broker's ads are, there could be issues that aren't apparent to the casual observer.

At the same time, be careful about relying on information, opinions, and advice provided by investment broker comparison sites. These sites are mostly aggregators that present brokerage services on an affiliate basis, which is to say they get paid to steer customers to the brokers.

You can spot these sites easily because they provide only the most superficial information, tell you everything is great, and never report any negatives connected with the service. These are ad sites, not objective advice sources, and they're pretty easy to spot.

12. Quality (and availability) of customer support

Even DIY investors sometimes need assistance from customer support. Make sure a firm offers such support, and it's available during more than just “regular business hours” (when your job might prevent you from calling).

Also, check to see if it's available in various forms. For example, email support and live chat can be more convenient contact methods than a direct phone.

If you prefer physical locations, you should favor a broker that has a branch location in your area. E*TRADE, for example, has more than 500 branches throughout the country.

13. Your own investment personality

Are you an active trader or buy-and-hold investor? Whichever you are will affect your choice of brokers. If you are a buy-and-hold investor and mostly invest in index funds, making only a very few trades per year, fund selection may be more important to you than low transaction fees.

You may even decide to invest with a fund family, particularly if they charge no fees on their own funds. On the other hand, if you are an active trader, executing dozens of trades per year, then transaction fees will be a major consideration.

Online broker comparison full list

| Company | Rating | Commissions and Fees | Features | Sign up | Review |

|---|---|---|---|---|---|

|

4.5/5 |

Min. Investment: $0

Stock Trades: $0/trade Options Trades: $0.65/contract |

Virtual trading, Margin | Open account | Read review |

|

4.5/5 |

Min. Investment: $0

Stock Trades: $0/trade Options Trades: $0.50/contract |

Auto Trading, Margin | Open account | Read review |

|

4.5/5 |

Min. Investment: $0

Stock Trades: $0/trade Options Trades: $1/contract |

Margin | Open account | Read review |

|

N/A |

Min. Investment: N/A

Stock Trades: N/A Options Trades: N/A |

N/A | Open account | Read review |

|

4.5/5 |

Min. Investment: $0

Stock Trades: $0/trades Options Trades: $0.65/contract |

N/A | Open account | Read review |

|

4.25/5 |

Min. Investment: $0

Stock Trades: $0/trade Options Trades: $0 |

Virtual trading, Margin | Open account | Read review |

|

4/5 |

Min. investment: $0

Stock trades: $0/trade Options trades: $0 |

Margin | Open account | Read review |

|

4.25/5 |

Min. investment: $2500

Stock trades: $0.01/trade Options trades: $0.75-$1 |

Virtual trading, Auto trading, Margin | Open account | Read review |

|

4/5 |

Min. investment: $0

Stock trades: $0/trade Options trade: $0.65/contract |

N/A | Open account | Read review |

|

3.3/5 |

Min. investment: $0

Stock trades: $0/trade Options trade: $0.60 per contract |

Virtual trading, Auto trading, Margin | Open account | Read review |

|

3.8/5 |

Min. investment: $0

Stock trades: $0/trade Options trade: $0.15-0.65 |

N/A | Open account | Read review |

|

3.8/5 |

Min. investment: $0

Stock trades: $4.88/trade Options trade: $4.88 + $0.50/contract |

Virtual trading, Margin | Open account | Read review |

|

3.5/5 |

Min. investment: $10000

Stock trades: $2.50/trade Options trade: $0.20 |

Virtual trading, Auto trading, Margin | Open account | Read review |

|

3.5/5 |

Min. investment: $0

Stock trades: $5/trade Options trade: $1 |

Margin | Open account | Read review |

|

3.5/5 |

Min. investment: $0

Stock trades: $0/trade Options trade: N/A |

N/A | Open account | Read review |

|

2.5/5 |

Min. investment: $0

Stock trades: $0/trade Options trade: N/A |

N/A | Open account | Read review |

Online brokers: The bottom line

Your online stock broker is your gateway to investing, so it’s not a decision to take lightly. When picking a brokerage, it’s essential to consider your unique investment needs and compare costs, available investment options, account types, and how well the stock broker works for your investment style. Any of these online stock brokers could be a great fit for your investing and trading goals.

Advertiser Disclosure– This advertisement contains information and materials provided by Robinhood Financial LLC and its affiliates (“Robinhood”) and Moneywise, a third party not affiliated with Robinhood. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. Securities offered through Robinhood Financial LLC and Robinhood Securities LLC, which are members of FINRA and SIPC. Moneywise is not a member of FINRA or SIPC.”